Mashreq Posts AED 2.1 Bn Net Profit For YE 2019

Mashreq, one of the leading financial institutions in the UAE, today has reported its financial results for the year ending 31st December 2019.

Key highlights [YE 2019 vs YE 2018]:

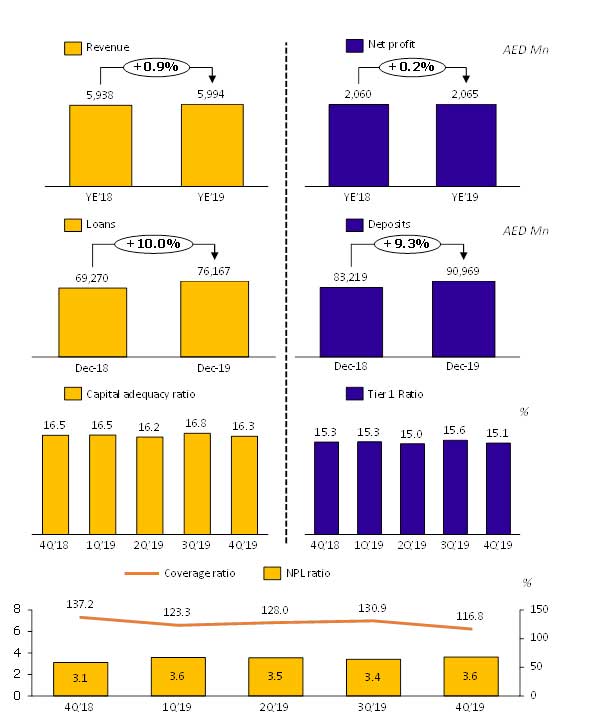

- Stable Net Profit

- Net profit for YE 2019 stood at AED 2.1 billion – stable vs 2018

- Impairment Allowance down by 1.5% YoY

- High proportion of non-interest income

- Mashreq’s best-in-class non-interest income to operating income ratio remained high at 38.2%

- Significant growth in Investment Income (AED 150 Mn in 2019 vs AED 27 Mn in 2019)

- Solid liquidity & Capital position

- Liquid Assets ratio stood at 32.6% with Cash and Due from Banks at AED 47.5 billion as on 31st December 2019

- Capital adequacy ratio and Tier 1 capital ratio continue to be significantly higher than the regulatory limit and stood at 16.3% and 15.1% respectively

- Strong Balance Sheet Growth

- Total Assets grew by 11.8% to AED 159.4 billion while Loans and Advances increased by 10.0% to reach AED 76.2 billion as compared to December 2018

- Customer Deposits grew by 9.3% during the year to reach AED 91.0 billion

- Loan-to-Deposit ratio remained strong at 83.7% at the end of 31st December 2019

- Sustained Asset Quality

- Non-Performing Loans to Gross Loans ratio stood at 3.6% at the end of December 2019

- Total Provisions for Loans and advances reached AED 4.0 billion, constituting 116.8% coverage for Non-Performing Loans

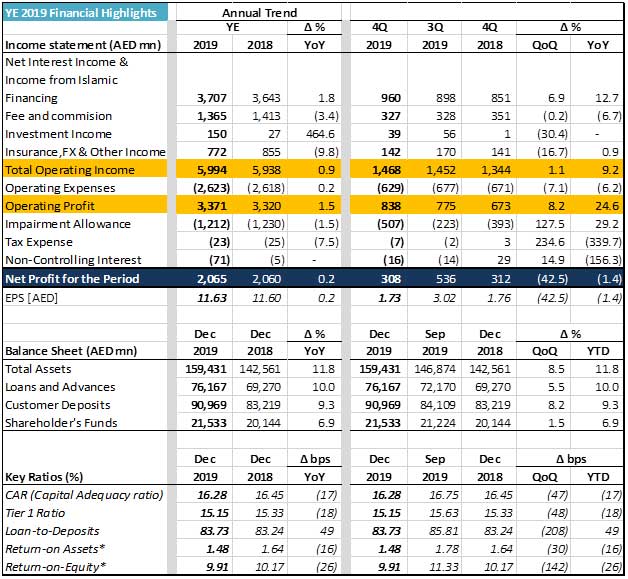

Exhibits:

Financial Highlights:

*Annualized

Mashreq's CEO, Ahmed Abdelaal, said: “Mashreq Bank continued to register strong performance and achieved a healthy net profit of AED 2.1 billion in the year. Importantly, this was achieved whilst maintaining a capital adequacy ratio and a Tier 1 capital ratio that was significantly higher than the regulatory limit at 16.3% and 15.2%, respectively. All of our businesses performed well and our total assets grew by 11.8% to AED 159.4 billion, while Loans and Advances increased by 10% over December 2018 to reach AED 76.2 billion.

The past year will be remembered as one that saw significant milestones for the bank. During 2019 we invested in, and executed, several digitization initiatives which will enable us to improve productivity, achieve cost efficiencies, enhance customer experience and unlock further value across our businesses. Notable among these was our branch transformation initiative, our collaboration with DIFC to launch the region’s first production-ready Blockchain KYC data sharing consortium in Q1 2020 and our new digital offering NeoBiz geared towards SMEs – the backbone of the nation’s economy.

The banking industry is evolving at a rapid pace and our clients, shareholders and regulators have a high expectation from banks to offer quick and real time services. This offers significant opportunities for banks such as Mashreq to capitalize on. Our core focus therefore continues to be towards catering to growing customer demand, enhancing the customer experience and empowering our people. Our digital transformation journey is not without its challenges but I am delighted to say that our staff have embraced this and our employee engagement score remains high. This is testimony to the expertise, professionalism and drive of our people, and our investment in the upskilling, learning and personal development necessary to keep us at the forefront of the digital revolution. We remain wholly committed to nurturing and developing Emirati talent. We have a dedicated national development program as we strongly believe they hold the key to establishing the UAE’s future legacy.

The added value that we can bring to our clients through innovation and technology is paramount to us and will remain the cornerstone of our strategy and the center of any transformation program that we conduct now or in the future.”

Mr. Abdelaal concluded, “As we head into 2020 – hailed as the Year of Getting Ready for the next 50 years in the UAE – there is never a doubt in my mind that we are approaching a significant period in the banking industry. The onus is now on us as an organization to continue seizing the opportunities in this era of disruption and innovation. The evolving needs of our customers is always the primary consideration whenever we roll out new initiatives, and therefore digitization continues to remain at the heart of our strategy. In the end, the goal is to provide outstanding customer experience, and I am delighted to say that we are well on track to deliver on that promise in the future also.”