Industries Qatar reports net profit of QR 1.5 billion for the three-month period ended 31 March 2021

Industries Qatar (“IQ” or “the Group”; QE Ticker: IQCD), today reported a net profit of QR 1.5 billion for the three-month period ended 31 March 2021.

Updates on macroeconomic environment

During Q1-21, macro economic environment continued the upward trajectory at a global scale that was manifested first during Q4-20. The GDP driven renewed consumer optimism following the vaccine rollout, easing of lockdowns in major markets, together with continued fiscal support to boost economies by many sovereigns, were some of the primary catalysts in the economic recovery leading to a renewed demand for commodities. Also, the supply shortages remained evident throughout the period across all the industrial sectors, especially the petrochemicals.

Updates on operational performance

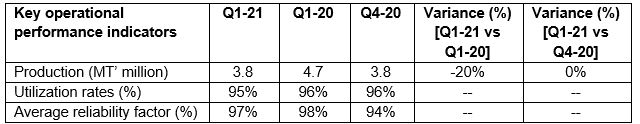

The Group’s operations continue to remain efficient with total Group production for the three-month ended period ended 31 March 2021 reaching 3.8 million MTs, down by 20% versus Q1-20. This reduction in production was mainly driven due to Group’s decision to mothball part of its steel facilities, since the start of Q2-20 for strategic reasons. Additionally, the production was also impacted by the commercial shutdown at the MTBE facilities for a period from December 2020 till February 2021. Moreover, certain fertilizer facilities (trains 1-4) were on a planned shutdown during Q1-21, amid focus on preventive maintenance. The Group’s utilization rates for Q1-21 reached 95%, while the average reliability factor stood at 97%.

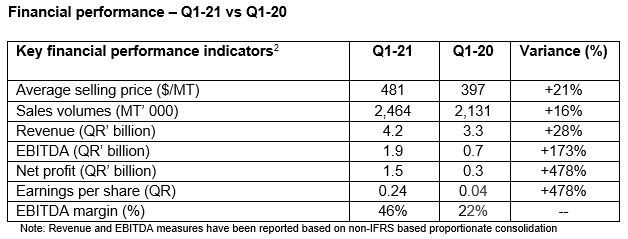

For the three-month period ended 31 March 2021, the Group recorded a net profit of QR 1.5 billion as compared to QR 0.3 billion for Q1-20, up by 478%. The Group revenue also inclined by 28% to reach QR 4.2 billion as compared to QR 3.3 billion for Q1-20 (assuming proportionate consolidation). Earnings per share (EPS) amounted to QR 0.24 for Q1-21 versus QR 0.04 for Q1-20. EBITDA increased by 173% and reached QR 1.9 billion for Q1-21 in comparison to QR 0.7 billion for Q1-20.

For the three-month period ended 31 March 2021, the Group recorded a net profit of QR 1.5 billion as compared to QR 0.3 billion for Q1-20, up by 478%. The Group revenue also inclined by 28% to reach QR 4.2 billion as compared to QR 3.3 billion for Q1-20 (assuming proportionate consolidation). Earnings per share (EPS) amounted to QR 0.24 for Q1-21 versus QR 0.04 for Q1-20. EBITDA increased by 173% and reached QR 1.9 billion for Q1-21 in comparison to QR 0.7 billion for Q1-20.

Group’s improved financial performance for Q1-21 versus Q1-20 was largely attributable to the following factors:

- Improvement in product prices:

Product prices on average inclined by 21% compared to Q1-20, translating into an increase of QR 1.0 billion in Group’s bottom line earnings. Improvement were noted across most of the segments, with fertilizer segment reporting the highest contribution of QR 0.5 billion, while petrochemical segment reported a contribution of QR 0.4 billion.

- Improvement in sales volumes:

Sales volumes furthered by 16% versus Q1-20, driven by a combination of reasons:

- Firstly, sales volumes relating to Qafco trains 1-4 were reported as part of Q1-21 volumes, which was not the case in Q1-20, as Qafco was operating under temporary gas processing arrangement and did not recognize sales volumes in relation to Qafco trains 1-4 for the first seven months of the financial year 2020.

- Additionally, the previous year’s sales volumes were affected by higher planned and unplanned shutdowns.

- Nevertheless, the improvement in the sales volumes were offset to an extent by the reduction in volumes during Q1-21, due to the mothballing of steel facilities, commercial shutdown in the fuel additives facilities and planned shutdown of certain fertilizer facilities.

- Improved OPEX savings:

Group operating expenses reduced by 8% versus Q1-20. This improvement was attributed to lower variable cost on account of lower production levels. The Group also benefited from the continuous cost optimization initiatives mainly implemented in the second half of 2020.

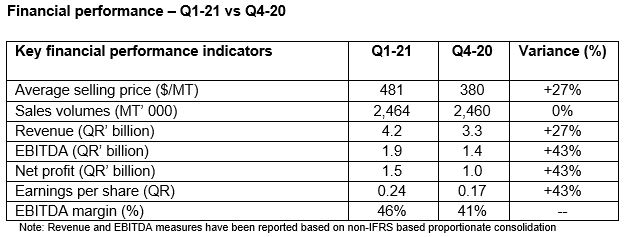

Compared to Q4-20, the Group revenue improved by 27%, while the net profits improved by 43%. The key contributor towards the growth was the overall increase in average selling prices, which continued their positive trajectory on the back of improved macroeconomic sentiments and supply challenges. Selling prices increased by 27% in Q1-21 versus Q4-20. Sales volumes on the other hand remained flat versus last quarter.

Compared to Q4-20, the Group revenue improved by 27%, while the net profits improved by 43%. The key contributor towards the growth was the overall increase in average selling prices, which continued their positive trajectory on the back of improved macroeconomic sentiments and supply challenges. Selling prices increased by 27% in Q1-21 versus Q4-20. Sales volumes on the other hand remained flat versus last quarter.

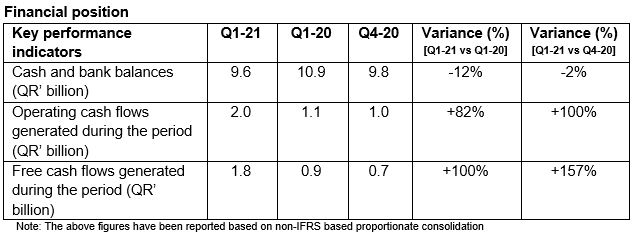

The Group’s financial position remains robust, with the liquidity position at the end of 31 March 2021 reaching QR 9.6 billion in form of cash and bank balances, after accounting for a QR 2.0 billion dividend payout for the financial year 2020. Currently, the Group has no long-term debt obligations. Group’s total assets and total equity reached QR 35.7 billion and QR 33.2 billion, respectively, as at 31 March 2021. During the period, the Group generated positive operating cash flows of QR 2.0 billion, with free cash flows of QR 1.8 billion.

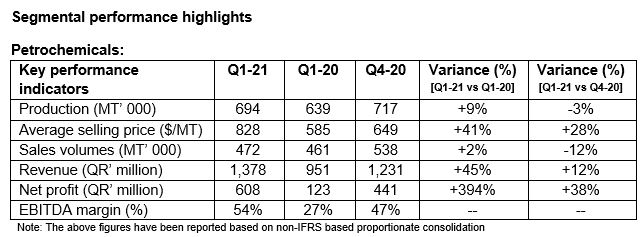

Performance of petrochemicals segment improved with a net profit of QR 608 million for Q1-21. This notable increase in profits was primarily driven by improved products prices with sustained recovery in the petrochemical prices.

Blended product prices in the segment rose by 41% versus Q1-20 with polyethylene (LDPE) prices showing a marked improvement of over 56%. Sales volumes marginally up by 2%, compared to the same period last year. The growth in product prices coupled with sales volumes led to an overall rise in revenue by 45% within the segment, to reach QR 1.4 billion for the current period.

Production volumes were marginally up on Q1-20, as the segment had higher operating days during the quarter, as the segment was on a planned periodic maintenance for some of its key facilities during Q1-20. Although, during Q1-21, the MTBE production volumes were impacted due to the commercial shutdowns, but it was entirely offset as some of the polyethylene facilities were on maintenance during Q1-20.

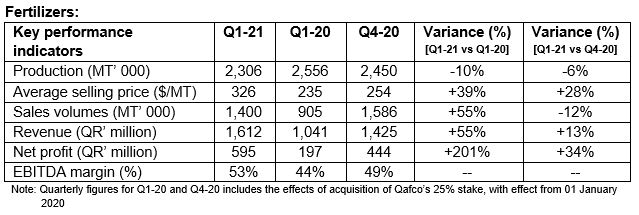

Fertilizer segment reported a net profit of QR 595 million for Q1-21, with a more than 200% increase versus last year. This increase was mainly driven by growth in revenues which increased by 55% in Q1-21 versus Q1-20, to reach QR 1.6 billion. Selling prices also improved by 39% versus Q1-20, which reflected positively on the segmental performance, leading to improvement of EBITDA margins.

Sales volumes also increased during Q1-21 in comparison to Q1-20 by 55%, for the same reasons as highlighted in the sales volume analysis. Production within the segment was down by 10% versus Q1-20, as Qafco trains 1-4 underwent higher days of maintenance shutdowns during the period as compared to the same period last year.

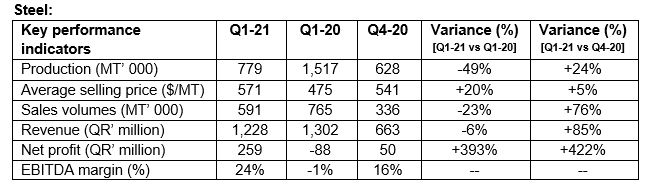

The steel segment continued its profit-making trajectory after having a difficult first half of 2020 and following the strategic restructuring initiatives implemented. The net profit for the current period amounted to QR 259 million versus a net loss of QR 88 in Q1-20. This noticeable improvement was mainly due to the following factors:

- Selling prices improved by 20% during the current period compared to Q1-20, due to increase in demand, along with higher raw material costs internationally.

- Mothballing of certain steel facilities allowed the segment to primarily focus on profitable domestic market, which led to adjust its cost base. Moreover, due to the improvement in the international prices, the segment was also able to sell some of the quantities outside the domestic market.

- By changing the raw material mix, the segment reduced it costs without affecting quality of the final product.

Earnings Call

Industries Qatar will host an IR Earnings call with investors to discuss the results, business outlook and other matters on 3rd May 2021 at 1:00 pm Doha Time. The IR presentation that accompanies the conference call will be posted on the ‘financial information’ page within the Investor Relations section of IQ’s website.