Middle East & North Africa Smart Grid Investments To Reach US$ 17.6 bn By 2027, Says Informa Markets Report

Smart grid investment in the Middle East and North Africa (MENA) is on track to reach US $17.6 billion over the next seven years, according to the Energy & Utilities Market Outlook Report 2020, a surge driven by greater attention to renewable energy sources across the region.

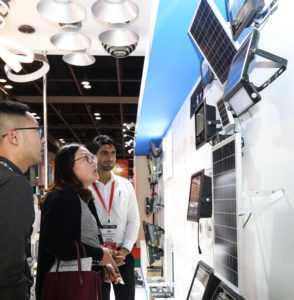

The growth forecast emerged from the report by Informa Markets, organiser of the mega Middle East Energy, the global energy platform that returns for a 45th edition at Dubai World Trade Centre (DWTC) from 3-5 March, and which will shine the spotlight on soaring demand for renewables with two-day Renewables Conference.

“Almost all MENA countries are establishing or planning renewable projects, including solar and wind,” explained Claudia Konieczna, Exhibition Director, Middle East Energy. “The steep decline in the cost of photovoltaic solar has prompted regional utilities to progress some of the world’s largest solar projects and analysts believe that by 2025, solar will amount to 37% of the region’s clean energy output.

“The impact for the smart grid market is immense as utilisation of renewable energy cannot be efficiently progressed through conventional grid systems which are now rapidly becoming outdated.”

The trend towards renewables as the region’s preferred energy sources will force a major MENA rethink on grid infrastructures, according to a UK energy services expert. Doug Waters, Director of Energy Services – Global, Uniper Energy Services says MENA grid transformation is integral to optimising renewable utilisation.

“As renewable penetration increases and is more decentralised and embedded, including new technologies and demands like electric vehicles, then the grid must adapt. Issues such as identifying demand and generation real time – even when deeply embedded – managing inertia, voltage control and other services will require the use of new grid technology and digitalization,” explained Waters.

Waters will address Middle East Energy’s Renewables Conference on day two (4 March) on the integration into the grid of significant renewables, the implications for fossil assets in energy transition and how digital technology can assist the process.

“As renewable penetration increases, the existing asset base, which is mostly gas fired in MENA, will move from baseload operation to running more flexibly. This means reducing minimum load but then moving to increased starts, increasing ramp rates and increasing provision of ancillary services,” Waters explained. “This requires changes in both the market and on-site strategies to manage the new operating regime and the risks and opportunities available.”

The free-to-attend Renewables Conference is part of a powerful knowledge platform running alongside Middle East Energy, which will be held at DWTC from March 3-5. It also includes six free-to-attend thought leadership plenary sessions and a Digitalisation in Energy Conference. Together the three forums comprise more than 30 conference sessions with more than 150 speakers providing up to 25 hours of insightful learning.”

Renewables also come in for added focus at Middle East Energy, formerly known as Middle East Electricity, as one of five dedicated product sectors, including Power Generation, Transmission & Distribution, Digitalisation and Energy Consumption & Management. More than 1,200 exhibitors from over 130 countries are due at the show which is expected to attract up to 48,000 attendees.