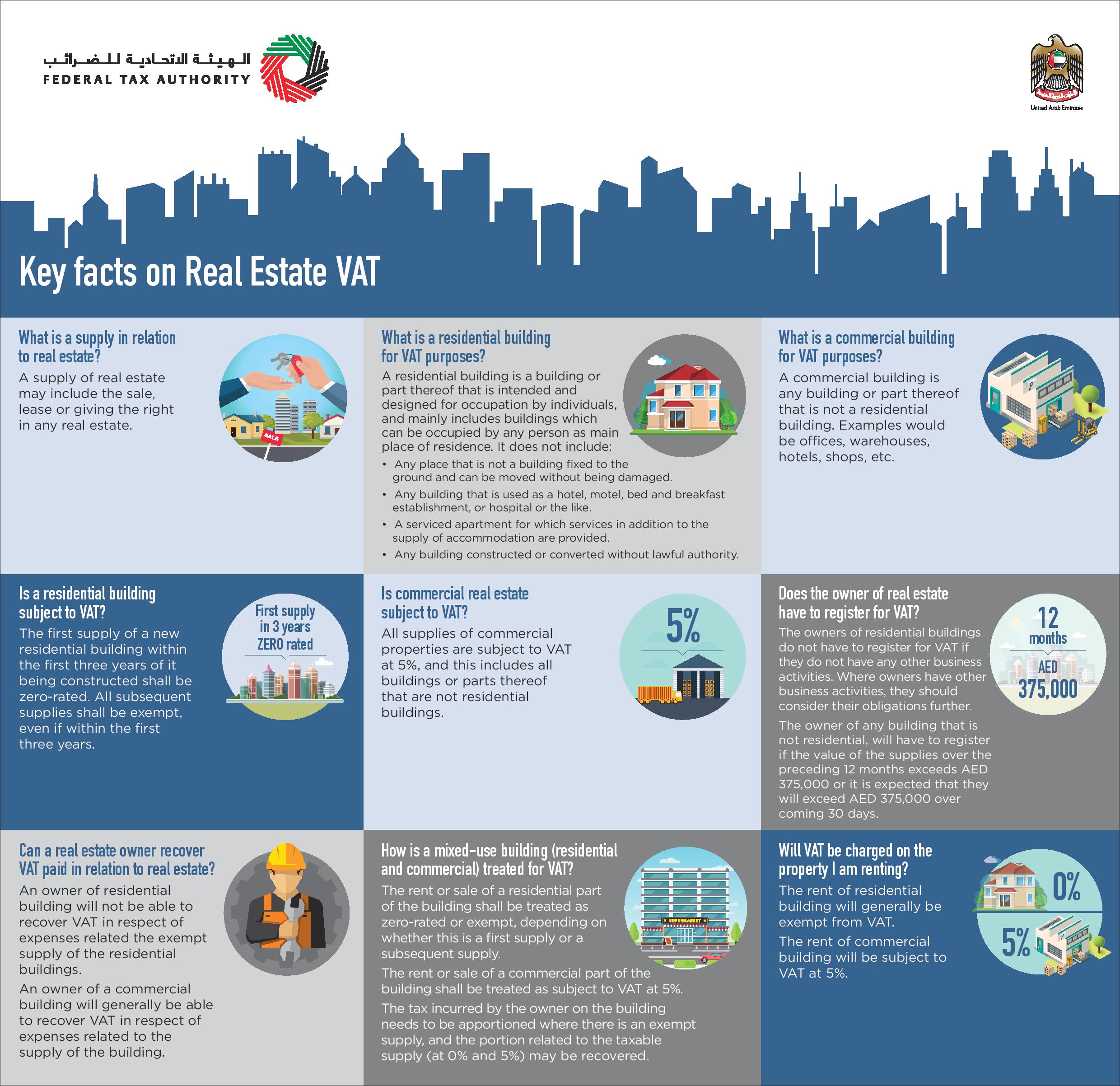

Federal Tax Authority Clarifies Regulations Regarding VAT For The Real Estate Sector

The Federal Tax Authority (FTA) has clarified regulations pertaining to Value Added Tax (VAT) when it comes to the real estate sector, stating that the supply of commercial real estate (selling or leasing) will be subject to the basic 5% tax rate, while residential units will remain generally exempt, except for the first supply of a new residential building within the first three years of it being constructed which will be 0% rated.

Residential and Commercial Buildings

The FTA defines the supply of real estate as activities that include, among other things, the sale, lease or giving of the right to any real estate.

A residential building is a building or part thereof that is intended and designed for occupation by individuals, and mainly includes buildings that can be occupied by any person as main place of residence. This does not include any place that is not a building fixed to the ground and that can be moved without being damaged; any building that is used as a hotel, motel, bed and breakfast establishment, hospital or the like; a serviced apartment for which services in addition to the supply of accommodation are provided; and any building constructed or converted without lawful authority.