Credit Card Issuers Face Reputation Wake-Up Call

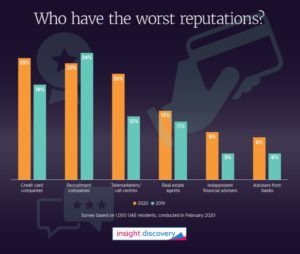

Almost one in four UAE residents perceive credit card issuers to be the least trusted of all financial providers, a new survey has found. The tenth edition of the Middle East Investment Panorama (MEIP) report included the results of a consumer survey which showed the percentage of respondents stating that credit card issuers have the worst reputation among a range of providers rose from 18% in 2019 to 23% this year.

Key highlights

- Credit card issuers were considered the least trusted of all financial provider. With Coronavirus wreaking havoc on personal finances, credit cards’ very high interest rates undoubtedly drove this negative sentiment

- Consumers on lower incomes (US $1,350- US $2,800) gave credit card issuers the worst scores, those earning more than +US $11,000 are reasonably well-disposed to credit card issuers

- Second place was occupied by recruitment companies, who were considered the worst profession last year, telemarketers came third with estate agents in the fourth position

- Whilst financial advisers occupied the same fifth position when compared to the 2019 survey the number of residents who thought they had a poor reputation jumped from 5% to 9%

Nigel Sillitoe, CEO of Insight Discovery said “It is not surprising to see that trust has become such an important issue. Credit card companies have a reputational problem in the Middle East, not too surprising when their monthly interest rates are often 3%, and annual percentage rate (APR) with some companies exceeds 40%.To regain their trust, credit card issuers should have a relook at their value proposition by exploring ways to prove they are out to help people manage their finances in these tough times.

While other financial providers in Canada and other countries are trying hard to help the working population during this COVID crisis we haven’t seen similar moves from card issuers in the Middle East. In my opinion certain credit card issuers should focus less on benefits (cash back schemes, fee golf, airmiles etc) and reveal the true cost of owning a credit card by being more upfront about APRs. Comparison websites in the Middle East are just as guilty as they list all the benefits and the monthly interest rate but rarely quote the APR”

Independent financial advisers, by contrast, did relatively well in the survey.

“Relative to other professionals, financial advisers have to cope with a wave of new regulation, including various initiatives by the authorities in the GCC countries, that have sought to improve the conduct of the advisers. The recently announced

rules of the Insurance Authority of the UAE, which are now due to come into force in October 2020, are merely the latest example. The advisers have met the challenges, and the industry will be stronger as a result”, he added.

“Quite unlike the global financial crisis of 2008-09, the COVID-19 pandemic was not foreseen and had its first impact on the real economy rather than in financial markets. On the basis of our MEIP research, we are optimistic that advisers can keep their clients engaged, especially those firms which use digital solutions. Twelve leading financial services companies supported MEIP, they included FRS, Morningstar, and SS&C Advent”.

Shamoli Arsiwala Sales Director – Middle East, Morningstar: “We are delighted to be recognised as the leading fund ratings company once again, the tenth time in as many years. Insight Discovery’s latest MEIP report highlights how advisers are coping with two major challenges – new regulations and the COVID-19 virus. This is an insightful and timely report as our industry adapts to create improved investor outcomes”

Frank Carr, Director, Financial Risk Solutions (FRS): ‘In the pensions industry, all eyes are on Dubai after the first mandatory long-term retirement and savings plan for employees in the DIFC was launched earlier this year. Not only is this great progress towards replacing the gratuity system and moving from an unfunded to a fully funded benefit, it also compels individual workers to provide appropriately for their winter years and is creating new opportunities for companies likes our to serve this market’

Click here to view MEIP report