COVID-19 – China’s Path To Recovery: What Can The Middle East Learn?

With stringent lockdowns coming into effect in the GCC’s two largest economies over the last week, many market stakeholders are looking to understand how long this pandemic will continue to restrain these economies and what the recovery will look like, when we emerge from our respective lockdowns.

The lifting of the 11-week lockdown in Wuhan, the epicentre of the COVID-19 pandemic, signifies a moment where all lockdown measures across the country have been removed and some form of normality can start to return.

Knight Frank Research states that weekly activity in the Chinese economy is estimated to be at over 85% when compared to the same period a year earlier. Whilst these initial data points may underpin a more optimistic outlook, there are many reasons to be cautious given the Chinese economy’s reliance on overseas demand; a downturn in overseas demand is likely to result in a more fragile domestic economic backdrop.

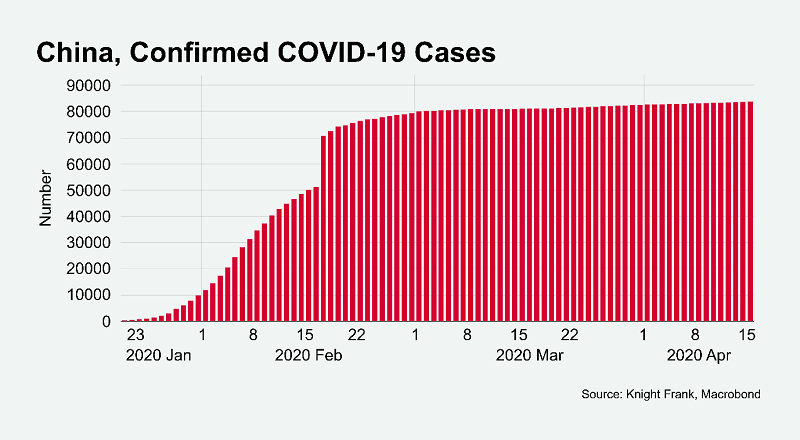

Knight Frank Research stated that the number of COVID-19 cases peaked in China on 17 February 2020, 28 days after the World Health Organisation started publishing official data for China.

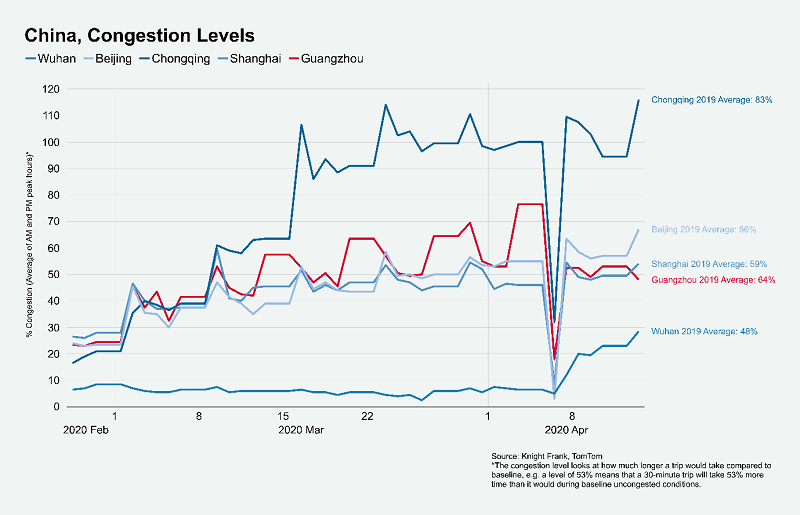

Congestion data from TomTom’s Traffic Index shows that roughly two weeks after this, major cities in China witnessed congestion levels starting to return to, and in some cases surpass, pre-lockdown levels. The dip in congestion volumes on April 4 2020 is due to the Qingming or Ching Ming Festival (Tomb-Sweeping Day).

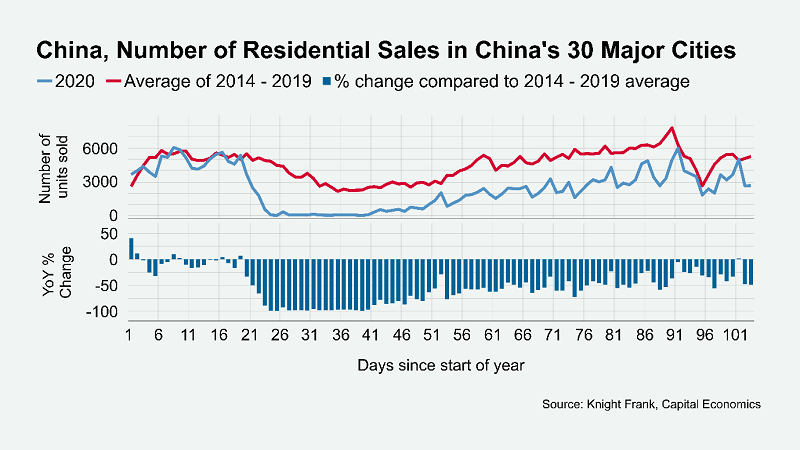

Unlike the rapid recovery in congestion volumes in China’s major cities, its property market is unlikely to witness a similar rate of recovery given the economic impact on a country and global level, the pandemic has had. Recent data supports this notion with China’s unemployment rate in its 31 large cities increasing from 5.2% in January 2020, to 5.7% in February 2020 and its consumer confidence and expectations at their lowest since mid-2018.

During the early stages of the year, residential transaction volumes witnessed up to almost 100% annual daily declines. In the year to date 12 April 2020, transaction volumes across China’s 30 major cities were 37% lower compared to the same period a year earlier. This rate appears to be moderating so it will be worthwhile keeping a close watch as to how this trend develops. The data roughly shows that after just over a month of congestion activity returning to normal, transaction volumes appear to rebound, yet it remains to be seen how long this will be sustained.

Assuming that the data from China holds true, it is possible that once the curve has flattened across the region, we can expect traffic volumes to normalise after two weeks and transaction volumes to begin recovering a month later. Whilst it is too early to accurately predict the point of normalisation in the Middle East, we will continue to bring you research from our global offices with relevant insights for property markets.